|

List of

Banks in the Caribbean

List of Banks in Aruba

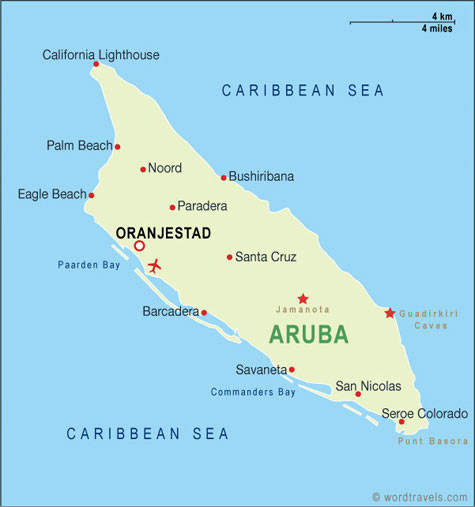

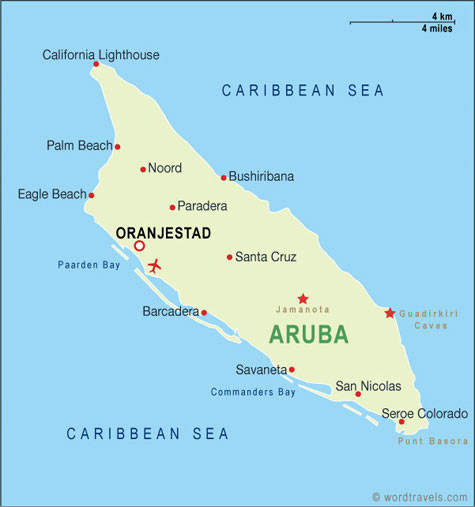

Aruba is a 33-kilometre (21 mi)-long

island of the Lesser Antilles in the southern Caribbean Sea, located 27

kilometres (17 mi) north of the coast of Venezuela. Together with

Bonaire and Curaçao, it forms a group referred to as the ABC islands of

the Leeward Antilles, the southern island chain of the Lesser Antilles.

Aruba, which has no administrative subdivisions, is one of the three

countries that form the Kingdom of the Netherlands, together with the

Netherlands and the Netherlands Antilles. Aruban citizens hold Dutch

passports. Unlike much of the Caribbean region, Aruba has a dry climate

and an arid, cactus-strewn landscape. This climate has helped tourism as

visitors to the island can reliably expect warm, sunny weather. It has a

land area of 193 square kilometres (75 sq mi) and lies outside the

hurricane belt.

Aruba Bank N.V.

Address: Camacuri 12

Mailing Address: P.O. Box 192

Phone: (297) 527-7725

Fax: (297) 527-7745

Aruban Investment Bank N.V. /AIB Bank

Address: Wilhelminastraat 34/36

Phone: (297) 582-7327

Fax: (297) 582-7461

Banco di Caribe N.V.

Address: Vondellaan 31

Mailing Address: P.O. Box 493

Phone: (297) 583-2168

Fax: (297) 583-2422

Keywords: Money

Caribbean Credit Corp.

Address: L.G. Smith Boulevard 116-B

Phone: (297) 582-3949 / (297) 583-7511 / (297) 582-1873

Caribbean Mercantile Bank N.V.

Address: Caya G.F. Betico Croes 53

Mailing Address: P.O. Box 28

Phone: (297) 582-3118 / (297) 583-6533

Fax: (297) 582-4373 / (297) 584-3535

Caribbean Mercantile Credit Company N.V.

Address: L.G. Smith Boulevard 116

Mailing Address: P.O. Box 601

Phone: (297) 582-1873 / (297) 586-0593 / (297) 584-6804

Fax: (297) 582-5116

Centrale Bank van Aruba

Address: J. E. Irausquin Blvd. 8

Phone: (297) 525-2100 / (297) 525-2101

Fax: (297) 583-2251 / (297) 583-7473

First National Bank of Aruba

Address: Caya G.F. Betico Croes 67

Mailing Address: P.O. Box 184

Phone: (297) 583-3221 / (297) 583-3224 / (297) 586-0005

Fax: (297) 582-1756 / (297) 582-3121

Interbank Aruba N.V.

Address: Caya G.F. Betico Croes 38

Phone: (297) 583-1080

Fax: (297) 582-4058

Ohra Hypotheekbank N.V.

Address: L.G. Smith Boulevard 62 Marisol Building.

Phone: (297) 583-9666

Fax: (297) 583-9498

RBTT Bank Aruba N.V.

Address: Caya G.F. Betico Croes 89

Mailing Address: P.O.Box 391

Phone: (297) 588-0101 / (297) 582-1515

Fax: (297) 582-1856 / (297) 583-9450

Sociale Verzekeringsbank

Address: L.G. Smith Boulevard z/n

Phone: (297) 587-3158

Fax: (297) 587-2783 / (297) 587-2787

Western Union

Address: L.G. Smtih Boulevard 142

Mailing Address: P.O. Box 656

Phone: (297) 582-2473 / (297) 582-4400

Fax: (297) 582-3012

Economy: Aruba enjoys one of the highest

standards of living in the Caribbean region; the low unemployment rate

is also positive for Aruba. About three quarters of the Aruban gross

national product is earned through tourism or related activities. Most

of the tourists are from Venezuela and the United States (predominately

from eastern and southern states), Aruba's largest trading partner.

Before the "Status Aparte" (a separate completely autonomous country/state

within the Kingdom), oil processing was the dominant industry in Aruba

despite expansion of the tourism sector. Today, the influence of the oil

processing business is minimal. The size of the agriculture and

manufacturing sectors also remains minimal.

The GDP per capita for Aruba is calculated to be $23,831 in 2007; among

the highest in the Caribbean and the Americas. Its main trading partners

are Venezuela, the United States and Netherlands.

Deficit spending has been a staple in Aruba's history, and modestly high

inflation has been present as well. Recent efforts at tightening

monetary policy are correcting this and will have its first balanced

budget in 2009. Aruba received some development aid from the Dutch

government each year, up until 2009 as part of a deal (signed as "Aruba's

Financial Independence") in which the Netherlands gradually reduced its

financial help to the island each successive year. The Aruban florin is

pegged to the United States dollar, with a fixed exchange rate where

1.77 Florin equals 1 U.S. dollar. In most stores near Oranjestad, the

exchange rate is 1.75 florin equals U.S 1 dollar

In 2006 the Aruban government has also changed several tax laws to

further reduce the deficit. Direct taxes have been converted to indirect

taxes as proposed by the IMF. A 3% tax has been introduced on sales and

services, while income taxes have been lowered and revenue taxes for

business reduced with 20%. The government compensated workers with 3.1%

for the effect that the B.B.O. would have on the inflation for 2007. The

inflation on Aruba in 2007 was 8,7%.

Language can be seen as an

important part of island culture in Aruba. The cultural mixture has

given rise to a linguistic mixture known as Papiamento, the predominant

language on Aruba. The official language is Dutch. The local language

used by its inhabitants is Papiamento and is a language that has been

evolving through the centuries and absorbed many words from other

languages like Dutch, English, French, diverse African dialects, and

most importantly, from Portuguese and Spanish. However, like many

islands in the region, Spanish is also often spoken. English has

historical connections (with the British Empire) and is known by many;

English usage has also grown due to tourism. Other common languages

spoken based on the size of their community are Portuguese, Chinese,

German and French. The latter is offered in high school and college,

since a high percentage of Aruban students continue their studies in

Europe.

In recent years, the government of Aruba has shown an increased interest

in acknowledging the cultural and historical importance of its native

language. Although spoken Papiamento is fairly similar among the several

Papiamento-speaking islands, there is a big difference in written

Papiamento. The orthography differs per island and even per group of

people. Some are more oriented towards the Portuguese roots and use the

equivalent spelling (e.g. "y" instead of "j"), where others are more

oriented towards the Dutch roots.

In a book The Buccaneers of America, first published in 1678, it is

stated by eyewitness account that the Indians on Aruba spoke "Spanish".

The oldest government official statement written in Papiamento dates

from 1803.

Aruba has four newspapers published in Papiamento: Diario, Bon Dia, Solo

di Pueblo and Awe Mainta and two in English : Aruba Today and The

News. Amigoe is the newspaper published in Dutch. Aruba also has 18

radio stations (2 AM and 16 FM) and three local television stations

(Tele-Aruba, Aruba Broadcast Company and Channel 22).

CENTRALE BANK VAN ARUBA & THE FINANCIAL

SYSTEM

The establishment of a central bank and the issue of a national

currency on the 1st of January 1986 marked the beginning of a separate

financial system for Aruba. Besides the Central Bank, the financial

system mainly consists of five commercial banks, (as of October 2001),

two US-based offshore banks, and other bank-like institutions of which

the most important are OHRA Hypotheekbank N.V., Fundacion Cas pa

Comunidad Arubano (FCCA), Aruban Investment Bank N.V., and island

Finance Aruba N.V. The institutional investor’s sector comprises life

insurance companies, and general (non-life)

insurance companies operating in or from Aruba.

CENTRALE BANK VAN ARUBA

The Centrale Bank van Aruba is a legal entity in itself (sui generis)

with an autonomous position within Aruba’s public sector. The Bank

started its operations on January 1, 1986, when Aruba obtained its

status as an autonomous country within the Kingdom of the Netherlands.

With the inception of the Bank, the Aruban florin was brought into

circulation,

pegged to the U.S. dollar at a rate of AFL 1.79 = US$ 1.00. This

exchange rate has remained unchanged since then. The mission of

the Bank is to maintain the internal and external value of the florin

and to promote the soundness and integrity of the financial system, to

be accomplished by

motivated and qualified employers, for the general benefit and well

being of the people of Aruba.

The Central Bank’s tasks and mission

The principal tasks of the Central Bank, as stipulated in the Central

Bank Ordinance are to:

• Conduct monetary policy;

• Supervise the financial system;

• Issue bank notes;

• Issue coins on behalf of the government;

• Act as the banker for the government;

• Be the central foreign exchange bank and, as such, regulate the flow

of payments to and from other countries;

• Advise the Minister of Finance on financial matters.

The Bank performs these tasks through a

variety of activities, which include:

• Formulating and implementing monetary policy and related measures

through, among other things, regulating bank credit and liquidity;

• Supervising the activities of the commercial banks and other financial

institutions by, inter alia, monitoring their liquidity and solvency to

protect the interests of depositors and policy holders, and to maintain

monetary and financial stability and financial integrity in Aruba;

• Managing Aruba’s official gold and foreign exchange reserves;

• Regulating international payments according to the State Ordinance on

foreign exchange transactions (A.B. 1990 No. GT 6);

• Bringing bank notes into circulation to meet the needs of businesses

and the general public;

• Issuing treasury bills and government bonds as an agent for the

government; and • Monitoring economic and financial developments.

FOREIGN EXCHANGE REGIME

The Centrale Bank van Aruba deals with the local foreign exchange banks

within a margin of 0.0279 percent. Accordingly, the Bank’s buying and

selling rates for the U.S. dollar are, respectively, AFL 1.7895 and AFL

1.7905. The rates for other main currencies against the Aruban florin

are set on a daily basis using the exchange rate of the U.S. dollar vis-à-vis

other major currencies as the basis for calculation.

FOREIGN EXCHANGE REGULATIONS

Foreign Exchange Transactions Pursuant to the State Ordinance on foreign

exchange transactions (AB 1990 no. GT 6), the bank is responsible for

the implementation of the regulations concerning foreign exchange

transactions for the account and risk of the government. These

regulations aim at monitoring and regulating the inflows and outflows of

foreign currencies. Payments to and receipts from nonresidents may be

made in any convertible currency.

Licenses

As of January 1, 1997, all current transactions with nonresidents may be

executed freely. When transferring company profits, a declaration of the

Bank should be obtained (among other things by submitting proof, e.g.,

annual accounts) stating that these profits were actually realized.

As of July 1, 1998, a general license was issued that allows resident

natural persons to carry out capital transactions (loans, investments,

and other capital transfers) with nonresidents up to a maximum amount of

AFL 200,000 per calendar year. For resident entities, capital

transactions higher than AFL 500,000 still require a special license.

These licenses are generally granted liberally. The amounts were

increased as of July 1, 2002, to respectively, a maximum amount of AFL

300,000 per calendar year for capital transactions with nonresidents,

and for resident entities, the capital transactions were increased to an

amount of AFL 750,000.

Investment regime for institutional investors (40-60 percent rule)

All institutional investors operating in Aruba, being life insurance

companies, pension funds, and saving funds, are required by the Bank to

invest a certain amount locally. The amount is related to the total

liabilities (excluding shareholder’s equity) of the institutional

investor, and is based on a progressive scale of 40, 50, and 60 percent.

Nonresident accounts

Nonresidents are free to open accounts (nonresident accounts) in any

foreign currency at a local commercial bank. They are also allowed to

hold bank accounts denominated in Aruban florin.

Conversion into Aruban florin

Proceedings from the export of goods and services must be converted into

Aruban florin or credited to a foreign currency denominated account

within eight working days after receipt, unless a special exemption is

obtained from the Bank.

Import and Export of Aruban florin

Nonresidents are allowed to bring into Aruba any amount of checks, or

bank notes denominated in foreign currency. The exportation of cash in

Aruban florin is prohibited, apart from certain small accounts for

travel purposes.

FOREIGN EXCHANGE TAX

The Sate Ordinance on foreign exchange commission stipulates that

residents must, in general, pay a 1.3% tax on payments to nonresidents.

Transactions in Netherlands Antillean guilders are exempted, on the

basis of an agreement between the two governments concerned. Certain

groups of companies (mainly government-related) are also exempted. This

was by virtue of the State Decrees on foreign exchange commission

exemption of July 1998 and October 2001, respectively. Additionally,

based on article 12 of the State Ordinance on the free zone of July

2000, the companies concerned may request an exemption to the extent

that their payments for

goods and services are linked to re-exports. Offshore companies and

Aruba Exempt Corporations (the so-called AVV’s) are by law

considered nonresidents and, thus, are not subject to this commission.

Pursuant to article 4 of the State Ordinance on foreign exchange

commission, the government is responsible for determining the policy

with respect to the foreign exchange commission, while the Bank is

entrusted with the collection thereof. In 2001, total collections rose

by 2% to AFL 24.4 million. Because of transitorial items, AFL 24.8

million was transferred to the Treasury. The share of this commission in

total tax receipts edged up from 3.8% to 4.1%.

FOREIGN EXCHANGE RESERVES

At year-end 2001, the total amount of foreign reserves of Aruba (excluding

revaluation differences of gold and official foreign exchange reserves)

amounted to US$ 373.9 million.

SUPERVISION OF FINANCIAL INSTITUTIONS

The Bank is entrusted with the prudential supervision of the Banking and

insurance sector as well as the company pension funds. This prudential

supervision aims at preventing financial institutions from taking risks

that could harm the interests of depositors and policyholders, and

endanger the stability of the financial system. To that end, continuous

off-site surveillance and periodic, risk-oriented on-site examinations

are conducted. Furthermore, regular bilateral meetings are held with the

institutions in

concern, as well as with the representative organizations to discuss

supervisory matters.

Depending on the type of financial institution, detailed reports are

submitted to the Bank on a weekly, monthly, quarterly, and/or annual

basis. Furthermore, each institution is required to file its own annual

audited financial statements and the management letter issued by its

external auditor. The Bank analyzes these documents and discusses its

findings with senior management of the institution.

COMMERCIAL BANKS

There are Currently five commercial banks operating in Aruba. One is a

branch and one a subsidiary of respectively, Banco di Caribe N.V. and

Maduro and Curiel’s Bank N.V., both established in Curaçao. Thus, two of

these five banks also are supervised (on a consolidated basis) by the

Bank van de Nederlandse Antillen.

The following commercial banks are currently active in Aruba:

• Aruba Bank NV;

• Banco di Caribe NV;

• Caribbean Mercantile Bank NV;

• Interbank Aruba NV;

• RBTT Bank Aruba N.V.

The aggregated balance sheet total of the five commercial banks

increased by 6 percent to AFL 2,430 million at the end of 2001

equivalent to 71 percent of estimated Gross Domestic Product (GDP).

Loans granted in 2001 grew by AFL 41 million or 3 percent to AFL 1,599

million, compared to a 13 percent increase in 2000. Loans to individuals

increased by 7 percent, while the commercial loans decreased by AFL 15

million or 2 percent. The latter is mainly as a result of the subdued

business activities.

On the liability side, deposits rose by AFL 102 million or 5 percent.

Capital and reserves increased with AFL 56 million or 6 percent.

As a result, the banks’ aggregated risk

weighed capital asset ratio increased from 8.1 percent in 2000 to 10.6

percent at the end of 2001, well above the minimum capital requirements

of 8 percent, adopted by the Basel Committee on Banking Supervision.

Compared to 2000 there was a substantial increase in the banks’

liquidity ratio by 4 percentage points to 28 percent well above the

minimum prudential requirement of 20 percent.

SOURCES:

Brochure of Centrale Bank van Aruba,

Tasks & Activities 2000

Annual Report 2001, Centrale Bank van Aruba,

Annual Report and Financial Statements for the year 2001

Havenstraat 2, Oranjestad, Aruba

Phone: (297) 822509

Fax: (297) 832251

E-Mail: cbaua@setarnet.aw

Website: www.cbaruba.org

ARUBAN INVESTMENT BANK

The Aruban Investment Bank N.V. (AIB), a private corporation, is a

result of the joint efforts of the Government of Aruba and the private

sector compromising international banks, local banks, insurance

companies, pension funds, corporations and the people of Aruba.

The total subscribed capital of the Bank amounts to AFL 14,967,000 as

per December 31, 1987 and is fully paid up. For increasing its financial

resources the Government of Aruba has originally granted the Bank a

subordinated loan sum of AFL 20,000,000.

The year 2000 witnessed a substantial growth in the loan and investment

activities of the Aruban Investment Bank N.V. These activities grew by

58% from AFL 60 million in 1999 to AFL 95 million for the year 2000.

The Bank has been successful in its approach to team up with

institutional investors in order to attract the long term funding,

essential for the growth of the loan and investment activities. The

borrowings of the Bank grew from AFL 29.6 million in 1999 to AFL 65.4

million in the year 2000, an increase of 120 %.

This directory is published solely as a

courtesy. We assume no responsibility or liability for the accuracy or

completeness of the listings or other information in the directory nor does we

assume any obligation to update this information. The data contained in this

directory has been compiled from a number of sources, however, we have not

independently verified the data. Therefore you may wish to verify the data with

your Bank institution.

Get your own Bank account with ATM card

(Maestro/Mastercard debit card) for withdrawals with a Bank in the Caribe

|